You might not be aware of it, but price sensitivity likely plays a daily role in your life. The economic concept determines many of your day-to-day spending decisions even if you don't think about them directly. Keep reading to learn more about price sensitivity.

Understanding price sensitivity

Understanding price sensitivity

Price sensitivity is sometimes called price elasticity. It's a way of measuring and identifying how sensitive consumers are to price changes in a given product. That means how much demand is affected by price changes.

Demand for some products can change substantially from just a small price change. Those products are known as elastic, or having high price sensitivity, while demand for other products could be relatively steady no matter what the price is. Those products are considered to be inelastic.

Why it matters

Why price sensitivity matters

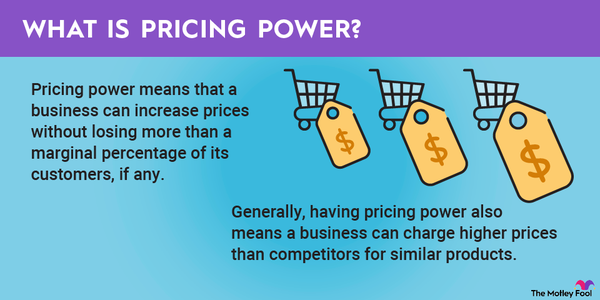

Price sensitivity matters to both businesses and consumers. Products with high price sensitivity tend to be more competitive and offer substitutes.

As a consumer, if you are shopping for a product with high price sensitivity, you'll likely have an easier time finding a deal. For such products, discounts may be frequent as sellers know that they can stimulate demand by lowering prices, and you can benefit from some comparison shopping. You may also be better able to negotiate prices for price-sensitive products like cars.

By contrast, products with low price sensitivity are more difficult to negotiate, such as healthcare or utilities. If a seller knows that a product is a need, rather than just a want, they have more control over the price and are less likely to lower it.

Some individuals can also be more price-sensitive than others. For example, wealthier consumers are likely to be less price-sensitive than lower-income consumers. Similarly, the state of the economy can affect price sensitivity since consumers are likely to be more sensitive when the economy is bad and they need to save money.

How it is determined

How price sensitivity is determined

Price sensitivity is primarily determined by the type of product in question and how easily consumers can find substitutes for that product.

For example, an article of clothing, such as jeans, is likely to have high price sensitivity. If the price of jeans jumps, consumers are likely to switch to khakis, corduroys, or another type of pants. The same could be said of food. If the price of oranges goes up, consumers will buy apples or bananas.

Products without convenient substitutes tend to have less price sensitivity. For instance, if you're sick and need medicine, you're likely to pay the price rather than look for cheaper alternatives or wait for a discount. Similarly, utilities like water or electricity also have low price sensitivity. Consumers need these products, so they'll pay the asking price. You can see by these examples that necessity also influences sensitivity. The more of a need a product is, the less price-sensitive consumers will be.

There are other factors that influence price sensitivity. One of those is rarity. Rare products like collectibles, art, or luxury products tend to have less price sensitivity. Often, consumers want the products in part because they are rare, which is unrelated to the price. By contrast, an individual product that is common and not unique, like a commodity, will have higher price sensitivity.

Switching costs also determine price sensitivity. If a product has high switching costs, sensitivity will be lower since consumers are essentially locked into buying that item. That explains why Apple (AAPL -1.23%) is able to charge a 30% commission on in-app purchases. Once you own an iPhone or iPad, you have little choice but to pay the fee if you want to spend money in the app. Similarly, developers need to be on those devices, so they also must pay the fee.

Relating investing topics

Example

An example of price sensitivity

Another common example of price sensitivity is airline tickets. Prices change frequently based on demand, which could be because of timing, weather, or other reasons.

Airlines will frequently lower or raise their prices based on demand since they know lower prices will entice more people to book tickets. Conversely, they'll raise prices when demand is high and supply is lower.

Travelers operate with a similar mentality. They'll shop around for the lowest price they can find, at times accepting a more inconvenient flight to save money. They'll also change dates, or maybe consider not going or going at a later date if prices are too expensive. This is especially true for leisure travel in which customers are choosing the dates and destination of their travel.

Price sensitivity is also one of the challenges that airlines face as market forces determine prices, and they have high fixed costs.

As a consumer, you have influence over price sensitivity as your purchasing decisions don't just affect the seller's bottom line, but they also affect the prices you see.