Microsoft (NASDAQ:MSFT) is the largest company in the technology sector and overall, ahead of Apple (NASDAQ:AAPL) and Nvidia (NASDAQ:NVDA). The top 10 tech companies by market cap are spread across a range of industries, including consumer electronics, semiconductor manufacturing, cloud computing, and e-commerce.

Largest tech companies

Largest companies by market cap in the technology sector

| Name and ticker | Market cap | Current price | Industry |

|---|---|---|---|

| Microsoft (NASDAQ:MSFT) | $3.4 trillion | $453.88 | Software |

| Apple (NASDAQ:AAPL) | $3.2 trillion | $211.31 | Technology Hardware, Storage and Peripherals |

| Nvidia (NASDAQ:NVDA) | $3.3 trillion | $135.20 | Semiconductors and Semiconductor Equipment |

| Broadcom (NASDAQ:AVGO) | $1.1 trillion | $228.54 | Semiconductors and Semiconductor Equipment |

| Taiwan Semiconductor Manufacturing (NYSE:TSM) | $1.0 trillion | $193.96 | Semiconductors and Semiconductor Equipment |

| Oracle (NYSE:ORCL) | $450 billion | $160.29 | Software |

| SAP (NYSE:SAP) | $346 billion | $296.44 | Software |

| Palantir Technologies (NASDAQ:PLTR) | $306 billion | $129.40 | Software |

| Salesforce (NYSE:CRM) | $279 billion | $291.03 | Software |

| ASML (NASDAQ:ASML) | $294 billion | $747.60 | Semiconductors and Semiconductor Equipment |

1-3

1. Microsoft

- Market cap: $3.24 trillion (as of May 5)

- Revenue (TTM): $270.0 billion

- Gross profit (TTM): $186.5 billion

- Five-year annualized return: 21.08%

- Year founded: 1975

Microsoft is the largest software company, and it's most well-known for the Windows operating system used by more than 70% of the world's desktop computers. In addition, it has a wide range of products, including Microsoft Office software, Azure cloud computing, and Xbox video game systems.

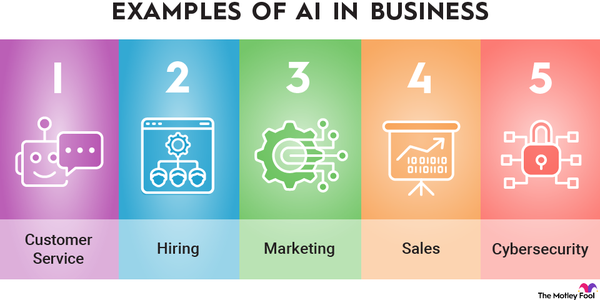

Like most major tech companies, Microsoft has invested heavily in artificial intelligence (AI). It started investing in OpenAI, the developer of ChatGPT, in 2019, and has since developed an AI digital assistant called Microsoft Copilot. For its 2025 fiscal year, Microsoft plans to invest $80 billion to build AI-enabled data centers.

2. Apple

- Market cap: $3.08 trillion (as of May 5)

- Revenue (TTM): $400.4 billion

- Gross profit (TTM): $186.7 billion

- Five-year annualized return: 23.93%

- Year founded: 1976

Apple is a consumer electronics company with a long list of popular products, including the iPhone, MacBook, iPad, Apple Watch, and AirPods. It became the world's biggest company on Aug. 9, 2011, and has mostly remained at the top since then.

It hasn't all been smooth sailing for Apple in recent years. The Apple Vision Pro, a mixed-reality headset, posted disappointing sales numbers. The release of Apple Intelligence, an artificial intelligence (AI) technology, has gotten mixed reviews. Apple is also embroiled in an antitrust lawsuit with the U.S. Department of Justice.

3. Nvidia

- Market cap: $2.79 trillion (as of May 5)

- Revenue (TTM): $130.5 billion

- Gross profit (TTM): $97.9 billion

- Five-year annualized return: 74.56%

- Year founded: 1993

Nvidia is a leader in the design and development of graphics processing units (GPUs). Its GPUs first gained popularity for use in video gaming and computers, and then as a way to mine cryptocurrency with GPU power.

In recent years, Nvidia GPUs have been instrumental in training AI models, driving up demand (and Nvidia's share price). Its market cap increased by more than $2 trillion in 2024, and it has briefly become the world's largest company on multiple occasions.

4-6

4. Broadcom

- Market cap: $957.51 billion (as of May 5)

- Revenue (TTM): $54.5 billion

- Gross profit (TTM): $34.5 billion

- Five-year annualized return: 54.79%

- Year founded: 1961 (HP Associates), 2005 (Avago Technologies), 2016 (Broadcom Limited)

Broadcom began as the semiconductor division of HP (NYSE:HPQ), but after a spinoff, multiple large acquisitions, and the AI boom, it's now one of the top tech companies. In addition to semiconductors, it also offers infrastructure software solutions.

Broadcom announced plans to purchase cloud computing and virtualization software company VMWare in 2022. It completed the transaction in November 2023, enhancing its software business.

5. Taiwan Semiconductor Manufacturing

- Market cap: $929.73 billion (as of May 5)

- Revenue (TTM): $100.9 billion*

- Gross profit (TTM): $58.6 billion*

- Five-year annualized return: 30.85%

- Year founded: 1987

*Converted from New Taiwan dollars.

Taiwan Semiconductor Manufacturing is a global leader in researching, designing, and manufacturing semiconductors. It produces chips for many of the major tech companies, including Apple, which is its biggest customer.

This semiconductor company is heavily expanding its operations in 2025. In March, it announced plans to invest $100 billion to build multiple U.S. facilities. It also opened a plant in Kaohsiung, Taiwan.

6. Oracle

- Market cap: $422.68 billion (as of May 5)

- Revenue (TTM): $55.8 billion

- Gross profit (TTM): $38.9 billion

- Five-year annualized return: 25.64%

- Year founded: 1977

Oracle is a database software and cloud computing company. It has a substantial enterprise customer base, with approximately 430,000 customers in 175 countries. Recently, Oracle has prioritized AI integration, adding a partnership with Nvidia.

Along with OpenAI and SoftBank (OTC:SFTB.Y), Oracle is a technology partner in the Stargate Project. The venture is expected to invest $500 billion into building AI infrastructure over the next four years.

7-10

7. SAP

- Market cap: $351.98 billion (as of May 5)

- Revenue (TTM): $39.7 billion*

- Gross profit (TTM): $29.2 billion*

- Five-year annualized return: 23.01%

- Year founded: 1972

*Converted from Euros.

German company SAP is the world's largest provider of enterprise resource planning (ERP) software. It offers products for supply chain and asset management, human resources and workforce analytics, and application integration and automation. SAP is a competitor to Oracle and has been acquiring cloud-based product companies for over a decade.

This tech company has had some legal troubles over the years. In 2024, SAP agreed to pay more than $220 million in fines to settle bribery charges.

8. Palantir Technologies

- Market cap: $293.19 billion (as of May 5)

- Revenue (TTM): $2.9 billion

- Gross profit (TTM): $3.9 billion

- Year founded: 2003

Founded by a group of former PayPal (NASDAQ:PYPL) employees, Palantir Technologies builds and deploys software platforms used for big data analytics. It has four main platforms: AIP, Foundry, Gotham, and Apollo. Billionaire entrepreneur Peter Thiel serves as the company's chairman and is also one of its co-founders.

Palantir Technologies partners with many major companies, including Amazon (NASDAQ:AMZN), Microsoft, and Oracle. It also provides military and defense software tools for the U.S. and its allies.

9. Salesforce

- Market cap: $263.93 billion (as of May 5)

- Revenue (TTM): $37.9 billion

- Gross profit (TTM): $29.3 billion

- Five-year annualized return: 12.11%

- Year founded: 1999

Salesforce provides customer relationship management (CRM) technology that companies can use to connect with their customers. Some of its top products include Sales Cloud for sales teams, Service Cloud for customer service, and Commerce Cloud, an e-commerce platform. It also acquired communications platform Slack in 2021.

Salesforce has incorporated AI into its business through AI agents. Businesses can use AI agents to gather data and automate customer assistance.

10. ASML

- Market cap: $271.50 billion (as of May 5)

- Revenue (TTM): $34.7 billion*

- Gross profit (TTM): $18.1 billion*

- Five-year annualized return: 20.91%

- Year founded: 1984

*Converted from Euros.

A Dutch tech giant, ASML provides semiconductor equipment systems. It manufactures and photolithography machines that other companies use to make the most advanced semiconductors.

While ASML is based in the Netherlands, it operates around the world, including in Europe, the U.S., and Asia. Some of its largest clients include Taiwan Semiconductor Manufacturing, Intel (NASDAQ:INTC), and Samsung (OTC:SSNL.F).

Takeaways

Technology sector takeaways for investors

The tech sector is an exciting one, where it's not unusual for companies to deliver market-beating returns. Most of the companies on this list have outperformed the S&P 500 over the last five years, and Nvidia and Broadcom have done particularly well.

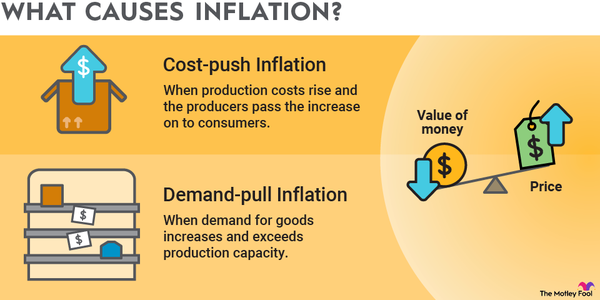

The tradeoff is that tech stocks tend to be volatile. For example, Nvidia has seen both the biggest one-day gains and losses in Wall Street history. Tech companies also frequently trade at high valuations.

In addition, the Trump administration's import tariffs are a serious concern for the technology sector. Many major tech companies have global supply chains, so tariffs force them to either move their manufacturing facilities or deal with increased costs.

There's greater risk to investing in tech stocks, so it's important to carefully research growth prospects for any you're considering. Even with the risk, technology companies are well worth it for the potential returns. After all, many of the most successful companies in the world are in the tech sector.