Income stocks produce a relatively stable income stream for investors. They can use this income to cover their expenses or reinvest it to buy more shares. Another benefit of investing in income stocks is that they're less volatile than growth stocks. These features make them a good addition to any portfolio, especially when seeking more stability.

Here's how to create a passive income investing strategy. We'll also take a look at some of the best income stocks to buy.

What are income stocks?

What are income stocks?

There are many types of stocks. An income stock is one that pays a relatively reliable dividend -- a portion of the company's profits-- to its shareholders. Dividend payments are typically cash disbursements that some companies regularly send to their investors.

Most companies pay quarterly dividends, although some provide income only annually or semi-annually. A few companies pay monthly dividends, making them ideal income stocks.

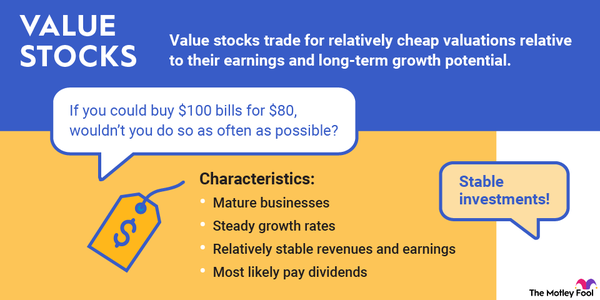

Unlike growth stocks, which investors buy primarily because they expect the share price to increase, income stocks are attractive to investors who want to earn passive income in cash. Investors earn a dividend yield, which is calculated by dividing the total annual dividend payments by the stock price. If a stock that pays a quarterly dividend of $0.25 per share (equal to $1 in annual payments) is trading for $20 per share, then its dividend yield is 5%.

Best income stocks

Best income stocks in 2025

The best income stocks offer an above-average dividend yield and have consistently increased their cash payouts over time. For example, a stock with dividend payments that increase by 10% annually doubles its cash payout to shareholders in a little more than seven years.

Dividend growth tends to drive a stock's price higher. Investors are typically willing to pay more for stocks that offer rising cash payouts, so investors in these companies enjoy the best of both worlds: passive income and stock price appreciation.

Here's a look at some of the best income stocks to consider.

1. Coca-Cola

Coca-Cola (KO 0.56%) pays a well above-average dividend. The beverage giant's dividend yield was almost 3% in early 2025, more than double the S&P 500's dividend yield of less than 1.5%.

Coca-Cola also has a terrific record of increasing its dividend. The company delivered its 63rd consecutive annual dividend increase in early 2025. That kept it in the elite group of Dividend Kings, companies with 50 or more years of consecutive dividend increases.

The beverage behemoth should have no trouble continuing to supply investors with a rising stream of dividend income in the future. The company's long-term goal is to grow its earnings per share at a high single-digit annual rate. With its earnings on the rise and a strong balance sheet, Coca-Cola should have plenty of pop to continue pushing its payout higher.

2. Verizon

Wireless and broadband subscribers of telecommunications titan Verizon Communications (VZ 1.14%) provide a reliable base of revenue and cash flow. Verizon generated an impressive $19.8 billion of free cash flow in 2024, giving it the funds to reward its shareholders with $11.2 billion in dividends.

Verizon's shares offered a hefty dividend yield of more than 6% in early 2025. The telecom giant has also increased its dividend for 18 straight years, the longest current streak in the U.S. telecom sector. Its attractive and growing income stream makes Verizon a great stock for earning passive income.

3. Johnson & Johnson

Healthcare behemoth Johnson & Johnson (JNJ 1.19%) pays a very healthy dividend. It offered a more than 3% dividend yield in early 2025. Meanwhile, it has 62 straight years of dividend increases.

The healthcare company is a financial fortress. It had an elite AAA bond rating (higher than the U.S. government). Johnson & Johnson ended 2024 with $25 billion of cash against $37 billion of debt. Meanwhile, it produced $20 billion of free cash flow in the period (more than enough to cover its $11.8 billion dividend outlay).

Johnson & Johnson expects to grow its operational sales at a 5%-7% annual rate through 2030. Meanwhile, its strong balance sheet will give it the flexibility to make acquisitions to further boost its growth (it has invested more than $30 billion in the past year on inorganic growth initiatives). These factors put it in a strong position to continue increasing its dividend.

4. Realty Income

Realty Income (O 1.63%) has been a dependable income stock over the years. The real estate investment trust (REIT) delivered its 110th consecutive quarter of dividend increases in early 2025 and has boosted its payout 130 times since its initial public offering (IPO) in 1994. It has delivered 30 years of dividend growth, putting it in the elite category of the Dividend Aristocrats®. (The term Dividend Aristocrats® is a registered trademark of Standard & Poor's Financial Services LLC.)

The REIT focuses on buying essential retail properties (think home improvement, grocery, and convenience stores), industrial real estate, and other properties (data centers and gaming). It triple-net leases (NNN) the freestanding properties to high-quality tenants, making them responsible for building insurance, maintenance, and real estate taxes and providing Realty Income with very stable income.

It steadily buys new income-producing properties, which should allow the trust to continue increasing its attractive monthly dividend. Realty Income yielded almost 6% in early 2025.

5. NextEra Energy

NextEra Energy (NEE 0.58%) has an excellent income track record. The utility is also a Dividend Aristocrat, with 30 years of consistent dividend growth. Over the past two decades, NextEra has increased its dividend at a 10% annualized rate.

It's one of the leaders in producing renewable energy and has an extensive backlog of development projects. Combine that growth with the stability of its utility operations, and NextEra should have plenty of power to keep expanding its earnings and dividend in the future. The company expects to increase its payout (which yielded around 3.5% in early 2025) by around a 10% annual rate at least through 2026.

Related investing topics

How to create a strategy

How to create an income investing strategy

One way to generate significant investment income is to build a portfolio of stocks based on their ability to produce dividend income. In addition to buying income stocks, you can purchase shares in mutual funds and exchange-traded funds (ETFs) that focus on dividend-paying stocks.

The objective of any income investing strategy is to create and benefit from a diversified portfolio of income-generating stocks. Owning many income-producing stocks from a variety of industries can offset the impact on your portfolio from any one company reducing or suspending its dividend, whether due to market conditions, financial struggles, or both. An income-focused diversification strategy should ensure that you generate enough steady income to meet your needs.

FAQs

FAQs about income stocks

What is an income stock?

An income stock is a publicly traded company that produces income for its investors via fixed quarterly dividends or distribution payments. Some income stocks also pay additional variable or special dividends. An income stock tends to have a higher dividend yield than the average stock because the company pays out a higher percentage of its cash flow in dividends. REITs, utilities, energy companies, healthcare companies, and some consumer companies tend to be good income stocks.

What is a good example of an income stock?

Realty Income is a good example of an income stock. The REIT pays a monthly dividend and typically has an above-average yield (almost 6% in early 2025 compared to less than 1.5% for the S&P 500). Realty Income also has a long history of dividend growth (more than 30 consecutive years).

Are income stocks a good investment?

Income stocks can be good investments. Historically, dividend stocks have produced much higher returns compared to nondividend payers (9.2% versus 4.3% from 1973-2024, according to data from Ned Davis Research and Hartford Funds). Companies with higher dividend payout ratios (40% to 75%) and, therefore, higher yields have outperformed the S&P 500 more often than companies with lower payout ratios and yields (60% to 70% from 1930 through 2024).