There have been some massive winners in the tech sector in recent years, but there has been a lot of turbulence as well.

On one hand, exciting new technologies like artificial intelligence (AI) have created many potential investment opportunities. But on the other hand, stock market volatility makes many investors hesitant to pick individual tech stocks.

That's where exchange-traded fund (ETF) investing comes in. An ETF allows you to invest in a specific area of the stock market without the downsides of picking individual stocks.

There are some excellent ETFs that focus either on the overall tech sector or a specific part of it. These can give you exposure to the high-potential tech space in your portfolio, but without the risks associated with investing in individual companies. In this article, we'll discuss seven top tech ETFs that are worth a look at for investors who may want to add diversified tech exposure to their portfolios.

7 Best tech ETFs

Seven best tech ETFs

| Name and ticker | Sector | Current price | Market cap |

|---|---|---|---|

| Vanguard Information Technology ETF (NYSEMKT:VGT) | Financials | $614.72 | |

| Select Sector SPDR Trust - The Technology Select Sector SPDR Fund (NYSEMKT:XLK) | Financials | $234.36 | |

| VanEck ETF Trust - VanEck Semiconductor ETF (NASDAQ:SMH) | Financials | $245.84 | |

| iShares Trust - iShares Cybersecurity And Tech ETF (NYSEMKT:IHAK) | Financials | $51.70 | |

| Invesco QQQ Trust (NASDAQ:QQQ) | Financials | $521.72 | |

| Invesco Exchange-Traded Fund Trust - Invesco S&P 500 Equal Weight Technology ETF (NYSEMKT:RSPT) | Financials | $38.44 | |

| Ark ETF Trust - Ark Innovation ETF (NYSEMKT:ARKK) | Financials | $57.41 |

1 - 4

Let's take a closer look at each of these ETFs:

1. Vanguard Information Technology ETF

Vanguard is well-known for its low-cost index funds. The Vanguard Information Technology ETF certainly falls into this category, with a rock-bottom 0.09% expense ratio. This means that for every $10,000 you invest, your annual fund expenses are just $9.

To clarify, an expense ratio isn't a fee you have to pay. It will simply be reflected in the ETF's performance over time.

This ETF tracks a broad index of U.S. tech companies of all sizes. However, it is a market-cap-weighted ETF, so its top holdings make up a larger proportion of its assets. In fact, the top three holdings -- Apple (AAPL -1.23%), Microsoft (MSFT 0.89%), and Nvidia (NVDA 0.01%) -- account for 46% of the fund's total assets. In short, the ETF is an excellent choice for investors who want a set-it-and-forget-it way to invest in the overall information technology sector.

Exchange-Traded Fund (ETF)

2. Technology Select Sector SPDR ETF

The Technology Select Sector SPDR ETF is offered by State Street (STT -0.09%). It is very close to the Vanguard fund, offering a similar asset size, a low 0.08% expense ratio, and a similar benchmark index. In fact, the fund's top holdings (and their respective weights) are nearly identical to the Vanguard example.

Both ETFs give you broad exposure to the information technology sector. It's tough to call one better than the other. Investors who just want to invest in "tech stocks" also won't go wrong with either.

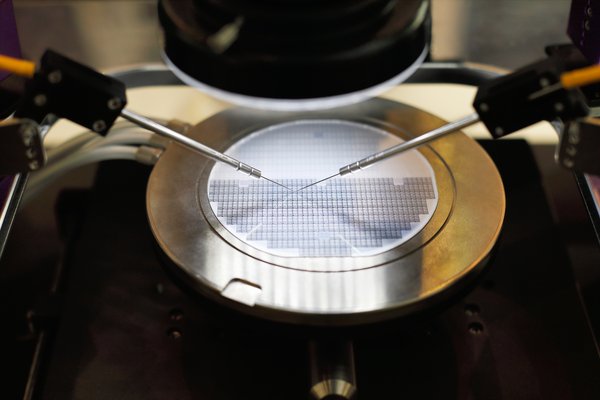

3. VanEck Semiconductor ETF

Now, we're getting into more specific ways to invest in tech stocks through ETFs. The VanEck Semiconductor ETF tracks an index of semiconductor manufacturers, commonly known as chipmakers. This can be an excellent way to invest in AI technology without having to buy individual stocks.

Since this is a market-cap-weighted fund, Nvidia is (unsurprisingly) the fund's top holding, making up about 20% of its assets. Others include Taiwan Semiconductor (TSM -0.44%), Broadcom (AVGO 0.75%), ASML (ASML 0.08%), Texas Instruments (TXN -0.07%), and Applied Materials (AMAT 0.09%). In all, there are 26 different chipmakers in the portfolio.

The ETF has a slightly higher 0.35% expense ratio. However, it's important to note that investors should expect to pay a bit more for specialized ETFs like this.

Semiconductor

4 - 8

4. iShares Cybersecurity and Tech ETF

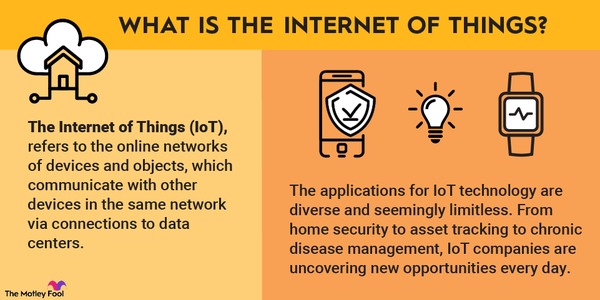

It seems like there is another high-profile data breach every other week, and the sophistication of threats (especially in the cloud) is increasing. Investing in cybersecurity stocks can be an interesting opportunity for patient long-term investors. The iShares Cybersecurity and Tech ETF lets you concentrate your money in this technology subsector.

The ETF has a 0.47% expense ratio, which is on par with others of similar size and specialization. It aims to track an index of cybersecurity stocks, and has 36 stocks altogether.

Top holdings include Check Point Software (CHKP -0.03%), Okta (OKTA -0.73%), Cyber Ark Software (CYBR -1.68%), and Juniper Networks (JNPR 0.22%), and many other names you might recognize.

5. Invesco QQQ ETF

No discussion of tech ETFs would be complete without mentioning the Invesco QQQ ETF. It is by far the largest Nasdaq-tracking ETF. The QQQ ETF has a relatively low 0.20% expense ratio and tracks the Nasdaq-100 index, which is essentially an index of the largest stocks listed on the Nasdaq exchange.

To be perfectly clear, the QQQ ETF isn't a pure tech ETF; it is just very tech-heavy. Nearly 60% of the fund's assets are invested in the technology sector, with another 17% in communications stocks. Top positions include Apple, Microsoft, Amazon (AMZN 0.18%), Google parent Alphabet (GOOGL 0.17%)(GOOG 0.2%), and Nvidia.

The Invesco QQQ ETF could be appropriate for investors who want passive exposure to a tech-heavy portfolio but don't want to depend exclusively on the technology sector.

Asset

6. Invesco S&P 500 Equal Weight Technology ETF

One major risk factor with all five ETFs discussed so far is that they're rather top-heavy. Because they are market cap-weighted and there are several blue chip tech stocks with trillion-dollar market caps, they are highly concentrated in just a few stocks.

But maybe you don't want half of your money in just Nvidia, Apple, and Microsoft.

The Invesco S&P 500 Equal Weight Technology ETF aims to create a truly diversified basket of tech stocks. This ETF allocates an equal amount of assets to every company in the index it tracks, which consists of 71 different stocks. This means that a relatively small company in the index, such as Hewlett-Packard Enterprises (HPE -1.72%), gets the same exposure as a massive company, like Microsoft or Nvidia.

The 0.40% expense ratio is quite reasonable for a unique ETF like this. It could be a smart choice for investors who don't want their investment returns to be too dependent on any single company's success.

7. Ark Innovation ETF

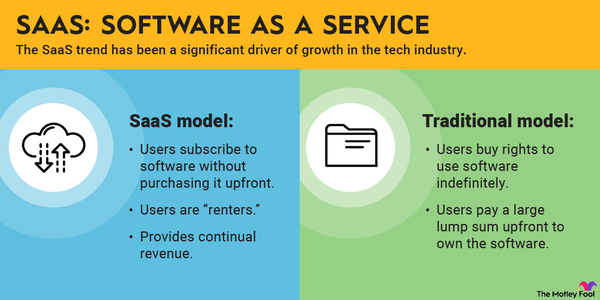

The first six ETFs all share one big characteristic: They are all passive funds. In other words, they are all designed to simply track an index of stocks and match its performance over time.

By contrast, the Ark Innovation ETF is actively managed by well-known investor Cathie Wood and her team. Its goal is to beat the market over time, and it is designed to capitalize on innovative and rapidly growing tech companies. The fund's five largest holdings are Tesla (TSLA -2.33%), Roku (ROKU -0.79%), Coinbase (COIN -0.93%), Roblox (RBLX -0.25%), and Palantir (PLTR -2.49%).

The idea is to invest the fund's assets in whatever opportunities seem the most attractive at any given time. By doing so, the Ark Innovation ETF aims to beat the performance of the overall tech sector. The fund hasn't exactly been a standout performer in the market downturn. But if you're looking for the potential of market-beating performance over the long run, this ETF is worth a closer look.

Related investing topics

The bottom line

The bottom line on investing in tech ETFs

As you can see, not all tech ETFs are identical. Some track a broad index of tech companies. Others track more specialized baskets of stocks. And some take an actively managed approach or weigh their portfolios differently.

The best course of action, if you're thinking about adding some tech exposure to your portfolio, is to compare each to see which is best suited to your goals and risk tolerance.